Directed activities survey

28/04/2023

Evaluation report

Over the course of the three-year period, the ELTW project aims to strengthen awareness and recognition of EU quality schemes (in particular PDO and PGI) and the graphic symbols that represent them in the 3 target countries.

Therefore, with the aim of verifying that the level of awareness and recognition increases among the subjects involved during the campaign, the monitoring system provides that on the occasion of all direct physical promotional activities (events, fairs, seminars, B2B meetings, training, study trips, tasting days) and digital (website, social media, augmented reality apps) questionnaires are administered both to Consumers and to the various types of Stakeholders (Journalists, influencers, professional market operators and Ho.Re.Ca . and the large-scale distribution channel).

To measure the change in knowledge and recognition that occurred thanks to direct activities, we will examine how the answers provided by individual respondents change over the three-year period. The number of responses will then be compared with the result indicators relating to the number of subjects who have come into contact with this project campaign in the markets involved.

To carry out the activities, Nomisma made use of the collaboration of highly specialized partners in digital supports for online surveys. Furthermore, the survey questionnaire, originally written in Italian, was translated by mother tongue professionals specifically selected by Nomisma in order to avoid bias deriving from the wording of the questionnaire.

During the first year, on the occasion of the direct activities, or specifically during the fairs attended in Italy and the in-store tastings in the 2 foreign markets, specific questionnaires were administered directly with the help of assigned personnel to the participants.

In detail, below are the direct activities carried out in which the evaluation questionnaires were administered:

- Rice Fair (14 September – 2 October 2022), an event held at the exhibition center in the municipality of Isola della Scala (VR) during which Italian rice is celebrated and, in particular, the excellence of Nano Vialone rice Veronese PGI.

- Fiera del Bollito (10 November – 27 November 2022), also at the Isola della Scala fair (VR), an event created with the aim of preserving and promoting one of the tastiest and most particular dishes of Veronese gastronomy, the “Bollito with Peara’”.

- Tastings in the Czech Republic (9-11 December 2022) and in Germany (18.11.2022 – 03.12.2022) in special promotional days in the stores, in which the tasting of the products was accompanied by information moments and materials on the promotional campaign.

It should be noted that the Evaluation Body was included in the activities in the second part of the first year of the Project (end of August 2022), as priority was given to other activities relevant to the Project as a whole. The administration of questionnaires, an integral part of the evaluation and monitoring activities, was therefore not implemented in the activities developed in the previous period.

The implementation of direct promotional activities made it possible to collect 156 questionnaires.

Of the 156 subjects interviewed, 59 took part in promotional activities on the Italian market (38 at the Rice Fair, 21 at the Bollito Fair), while the remaining 97 took part in tastings in the Czech Republic and Germany (51 and 46 respondents respectively).

The participants in the activities (who shared their personal data) are distributed evenly by gender (with a slight prevalence of females, 55% of the sample) and belong above all to the intermediate age groups: 38% have 20 and 39 years old, while 29% are between 40 and 59 years old. The shares of very young participants are more contained (12% are under 20 years old), while 21% of the sample is over 60 years of age.

As far as the type of respondent is concerned, almost all of the sample is made up of consumers who took part in the various activities, thanks to the realization of the surveys in activities involving the general public. The presence of operators is limited to a single respondent in the media and communication category, i.e. an Influencer participating in the Rice Fair.

Finally, as regards the nationality of the participants in the individual initiatives, the composition is diversified for each market: if in the 2 fairs of Isola della Scala all the participants are Italian, in Germany almost 1 respondent out of 4 is of foreign origin and in the activities in-store in the Czech Republic this share does not reach 4%.

Starting from the processing of the collected data and considering only the fully completed questionnaires (in order to have a homogeneous analysis basis), the following paragraphs offer a summary picture of the performance of the activities carried out divided by country and activity (fair/tasting) carried out . In light of the non-statistically representative numbers (156), the details on the sub-samples (e.g. age group) will not be analyzed in this year.

THE QUESTIONNAIRE

In order to standardize the monitoring of the project, the administration of the same questionnaire was envisaged in the various events, which on the basis of the specific contents is divided into two main sections (in addition to the questions for profiling the respondent): the first in which the recognition of the PDO and PGI logos, as well as the awareness and previous knowledge of the interviewees on the high quality standards and environmental protection guaranteed by European PGI and PDO branded products; the second in which we want to verify the incisiveness, effectiveness and usefulness of the event in achieving the project objectives (i.e. the increase in knowledge and recognition), with a focus on the interest generated by the activity towards specific quality products (with different nuances depending on the type of respondent, to capture diversified but synergistic information), but also in understanding what added value is perceived with respect to PDO and PGI products.

Specifically, the questions proposed are the following (in addition to the questions on the type of event and the respondent’s summary profiling information).

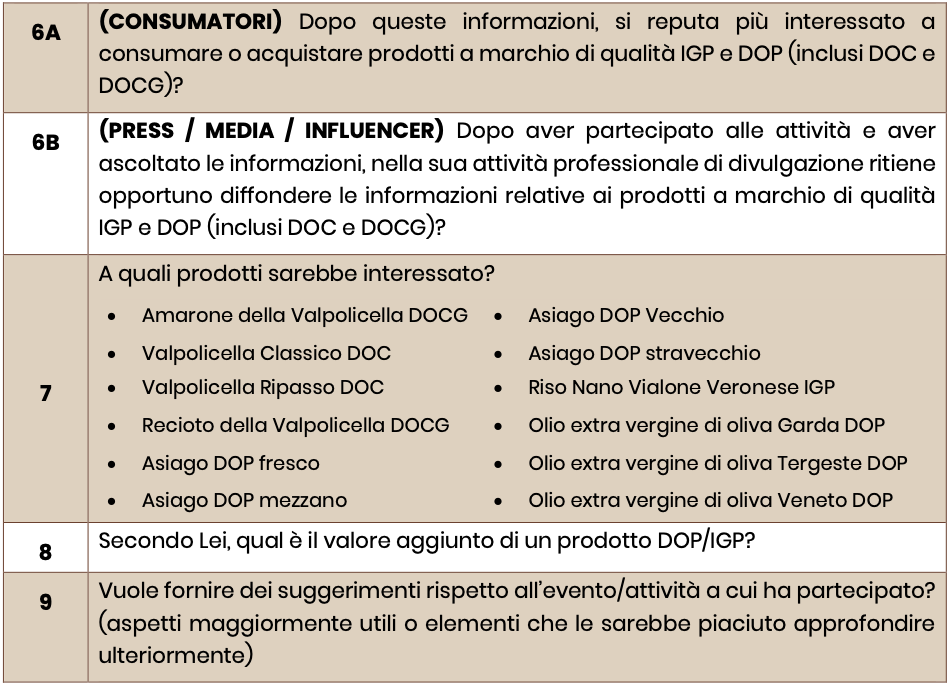

ANSWERS TO INDIVIDUAL QUESTIONS AND OVERALL INDICATORS

Analyzing the answers provided to the individual questions in detail, it emerges that the visual recognition of the PDO and PGI logos is found on average in almost one out of 2 respondents (48% and 46% of the sample respectively), but with varying incidences highly for single activity carried out and associated with a different previous level of knowledge of the specific characteristics of the PDO and PGI products that have those graphic symbols. In particular, examining by single event, as regards the tastings in the Czech Republic and the participants in the Rice Fair, despite the fact that the ability to recognize both the PDO and PGI graphic logos is more limited, the participants in these two activities stated that they are already aware of some peculiarities of PDO and PGI products (respectively 75% and 63% of respondents). On the contrary, the a priori awareness of the high standards of quality, food safety and sustainability of these products is instead much less marked in the participants in the Bollito Fair and in the tastings in Germany, who on the contrary had shown that they graphically recognized the identification marks of the PGI and PDO denominations.

In any case, these misalignments between the ability to recognize logos and knowledge of some of the elements that distinguish quality productions

Evaluation report on promotional investments (R.UE 1144/2014) – “European Lifestyle: taste wonderfood” program – 1st year underline that in the markets involved in the promotional program – including Italy – there is ample space to further explore the aspects of the information and promotional campaign, strengthening awareness of the brands that distinguish PDO and PGI products, to make them more easily identifiable.

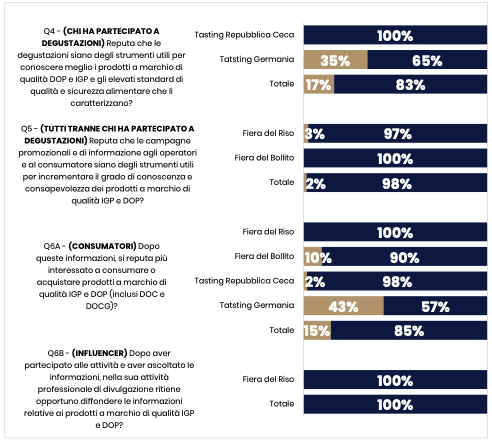

Moving on to analyze the outcome of the initiatives carried out, 87% highlight an improvement in their knowledge and awareness of PDO and PGI branded products, which arose as a result of the activities in which they took part. This positive judgment is transversal among the various initiatives carried out, although with a more moderate degree among the participants in the tastings in Germany (61%).

(Positive) moderation that also emerges on the judgment regarding the effectiveness of the actions implemented, with 65% of German consumers who believe it was useful to participate in the tasting of PGI and PDO branded products, despite the clearly positive feedback for the others three events (one tasting and two fairs) on the ability to improve participants’ level of knowledge and awareness of the promoted products.

The proactivity that arises following the promotional and informational event is clearly positive for all targets: in detail, 85% of the consumers interviewed declare themselves interested in trying (today or in the future) the products object of the promotion, while, in case of the participating influencer, an interest in disclosing information about these specific products emerges. Analyzing by single market, in Italy and the Czech Republic 9 out of 10 consumers say they are interested in buying these products, while in Germany the propensity to buy is also more contained in this case, but still positive (57%) .

Below are the response percentages of the interviewees to the individual questions of the questionnaire administered, analyzed by event.

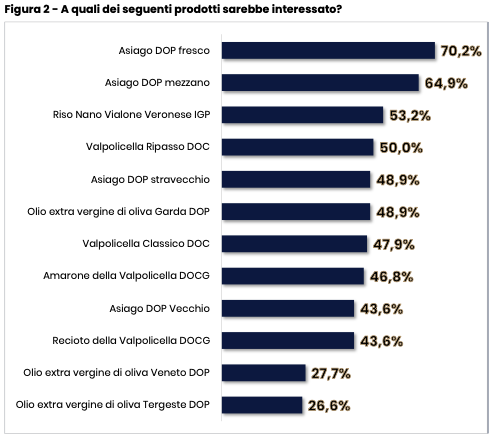

By instead focusing attention on the individual products covered by the promotional campaign, it emerges that Asiago DOP is the product on which the most attention falls: in particular, one respondent out of seven declares to be interested in buying fresh Asiago DOP, while it is the share of those who would like to consume Asiago PDO mezzano (65%) is slightly lower. There is an interest that exceeds one participant out of 2 also for Riso Nano Vialone Veronese IGP and Valpolicella Ripasso DOC, while for the other products, although they were all of interest, the incidences are more contained.

An open question was then inserted asking what was the added value of a PDO/PGI product according to the respondent. Depending on the reference market, the response rate recorded is different. In Italy, 71% of the participants in the two fairs shared their opinion regarding the aspects that give value to PDO/PGI products; in the Czech Republic, on the other hand, only 16% expressed their perception on the subject, while in Germany no respondent expressed their point of view.

The added values of DOP and IGP products most frequently encountered are the quality and specific origin of the product, followed by superior taste and control of the supply chain and production process which give the consumer a greater sense of security. Furthermore, several participants highlight aspects that are attributable to the theme of sustainability, such as systemic valorisation of the territory and non-intensive farming.

Fresh Asiago DOP Asiago DOP mezzano Nano rice Vialone Veronese IGP Valpolicella Ripasso DOC Asiago DOP stravecchio Extra virgin olive oil Garda DOP Valpolicella Classico DOC Amarone della Valpolicella DOCG Asiago DOP Vecchio Recioto della Valpolicella DOCG Extra virgin olive oil Veneto DOP Extra virgin olive oil Tergeste PDO

At the end of the questionnaire there is a question asking for any suggestions regarding the activities just carried out, with the aim of collecting feedback aimed at optimizing some elements with a view to future promotional initiatives to be implemented over the three-year period. In this case, the participants in the fairs in Italy are much less inclined to provide their point of view (only 8% responds, as well as in Germany), while in the Czech Republic one in three consumers shared their opinion on how to enhance the initiatives implemented.

In the Italian market, the introduction of a point of sale at the fair and the possibility of tasting a greater number of PDO/PGI branded products are the most highlighted proposals as well as a particular interest with respect to Asiago PDO, with some respondents reporting the interest in further studying the production methods at the base of the appellation cheese. In Germany, on the other hand, there is a lot of curiosity about the methods for best preserving PDO/PGI products (in particular the promoted PDO Asiago cheeses), while in the Czech Republic there is hope for the presence of information-promotional moments in markets and gastronomic events more structured, as well as the introduction of an ad hoc tasting room.

In addition to the answers given to the individual questions, to contextualize the evaluation of the project and to analyze in synthesis the performances functional to the evaluation during the three-year period, specific synthetic indicators have been developed, created on the basis of concomitant answers to the questions in the questionnaire. Specifically, the summary framework is as follows:

| Riconoscibilità | basata sulla risposta concomitante ai quesiti 1A e 1B | + Positiva (tutte risposte positive) 46% − Negativa (tutte risposte negative) 52% |

| Awareness | basata sulla risposta concomitante ai quesiti 1A, 1B e 2 | + Positiva (tutte risposte positive) 32% − Negativa (tutte risposte negative) 30% |

| Utilità | basato sulla risposta positiva: Al quesito Q4 per le degustazioni Al quesito Q5 per le fiere | 88% |

| Interesse potenziale | basato sulla risposta positiva: Al quesito Q6A per i consumatori Al quesito Q6B per gli influencer | 85% |

The recognition indicator, i.e. the concomitant knowledge of the PGI and PDO brands, highlights how there is a need to further investigate some aspects of the promotional campaign. In fact, it emerges that the share of those who do not recognize either the PDO or the PGI logo (52%) exceeds the share of participants who claim to be familiar with both brands (46%). Also in this case, the incidence varies according to the reference event, an indication of a previous level of heterogeneous graphic knowledge on the various markets. The participants in the Fiera del Bollito and in the tastings in Germany show a more accentuated visual knowledge of the brands (with a positive recognition index of 67% and 59% respectively), unlike those who attended the Fiera del Riso and at the tasting in the Czech Republic (with much lower recognition, respectively equal to 39% and 29%).

As far as awareness is concerned, i.e. the a priori knowledge not only of the specific logos but also contextually of the specific characteristics of the European PGI and PDO branded products promoted, it is highlighted how overall in the events held in the first year of the promotional campaign the value of awareness negative (30%) is slightly lower than the specular positive (32%), index of a limited overall and synergistic knowledge of the merits of the quality products promoted among the participants, with ample room for improvement. Analyzing the differences between the various events, it emerges that the Rice Fair is the initiative with the highest positive awareness value, albeit rather low (just 37%), while the Czech market once again demonstrates limited pre-event awareness of European PDO and PGI branded products (just one consumer out of four recognizes both logos and at the same time was already aware of some of the quality standards of the products). This confirms that it is necessary to further investigate information and promotional activities in the markets involved, to strengthen consumer and operator awareness of the peculiarities that distinguish PDO and PGI products and to make them more easily identifiable and better known.

As evidence, however, of a campaign already very effective, indicators of utility and potential interest, which reflect respectively the validity of the promotional tools deemed useful to increase the level of knowledge and awareness of the PGI and PDO quality label products, together with the propensity of the participants to buy or disseminate information on the products promoted, they turn out to be very elevated, sign of a process that evidences a positive performance already from the first annuality. In the detail of the individual markets, only in the German one is found a more contained interest, even if positive (57%), while in the other markets almost all the participants agree with the usefulness of the promoted initiatives and manifest a strong propensity to buy (for consumers) and the dissemination of useful information (for the influencer who took part in the Rice Fair) about PDO and PGI branded products.

FIRST YEAR: SUMMARY OF THE MAIN RESULTS ACHIEVED BY THE PROGRAM

Evaluation of program results

The first year was mainly aimed at planning the entire three-year campaign in detail, defining the communication strategy and creating the visual identity. Some of the envisaged activities have not been operationally implemented, but will be recovered over the next two years, in order to follow up on the provisions of the three-year project.

The activities actually carried out have given rise to ambivalent but tendentially positive results. Specifically, the PR Actions, the Stands at the fair and the Tasting Days guaranteed excellent results, while the performances of the activities concerning the Creation of advertising promotional gadgets and those relating to Seminars, workshops, meetings between companies, training were less positive commercial/cooking courses or activities in schools.

It is essential that in the next two years a further effort is made, in addition to pursuing the goals set for each individual period, to recover the activities not carried out during the first year, including the press events, the website, the social media and the Study trips in Europe, in order to guarantee the overall performance of the project and its impacts.

Direct Activities Survey

During the first year of the programme, a total of 156 questionnaires were collected, filled in by participants in rice and boiled meat fairs, held at the fairgrounds in the municipality of Isola della Scala (VR), and by participants in tastings in Germany and the Czech Republic.

In summary, we can summarize below the main results that emerged from the survey:

- Intermediate knowledge of PDO and PGI branded products, with wide margins for further study

- Remarkable usefulness and effectiveness of the initiatives implemented

- High propensity to purchase and disseminate information relating to PDO and PGI branded products by event participants

- Quality, traceability, sustainability and taste are perceived as the added value of a PDO or PGI certified product

- Possibility to taste a greater number of products and more detailed knowledge of production techniques and methods of conservation of the same are the aspects that the participants would have liked to deepen more

- The German market tends to be more moderate, both in considering activities useful and in the propensity to purchase